You may create a FREE account in valueresearchonline.com and start your discovery.

Note: Past performance is no guarantee of future results.

Fund Performance:

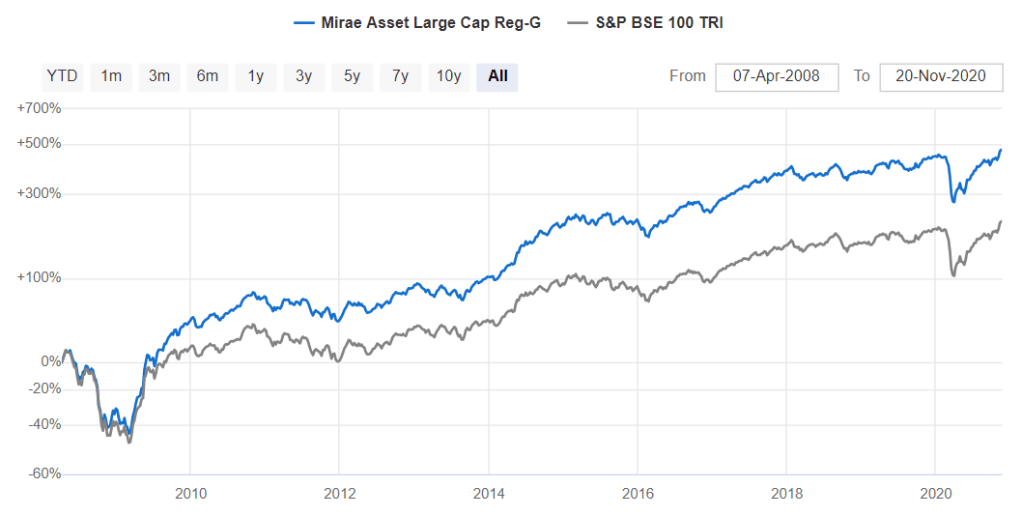

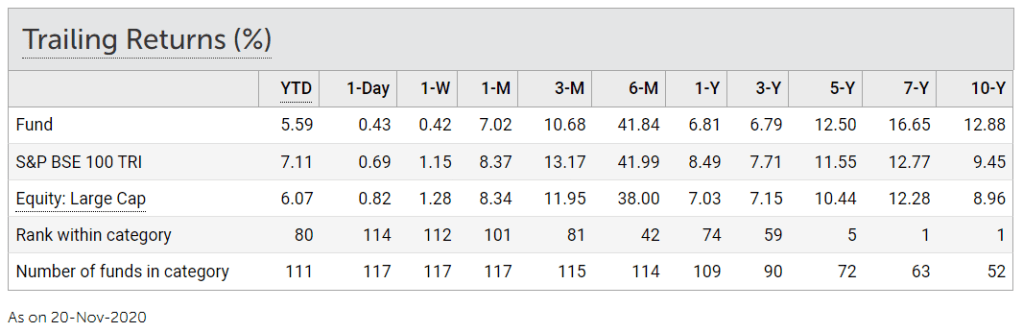

I look at the fund performance for at least 10 years. Mirae Asset Large Cap Fund has outperformed the BSE index over the last 10 years.

Returns (%): I look at the returns over the 3-Year, 5-Year, and 10-Year period. Mirae Asset Large Cap Fund has underperformed the BSE index in 3-Years and outperformed the BSE index over 5-Y and 10-Years.

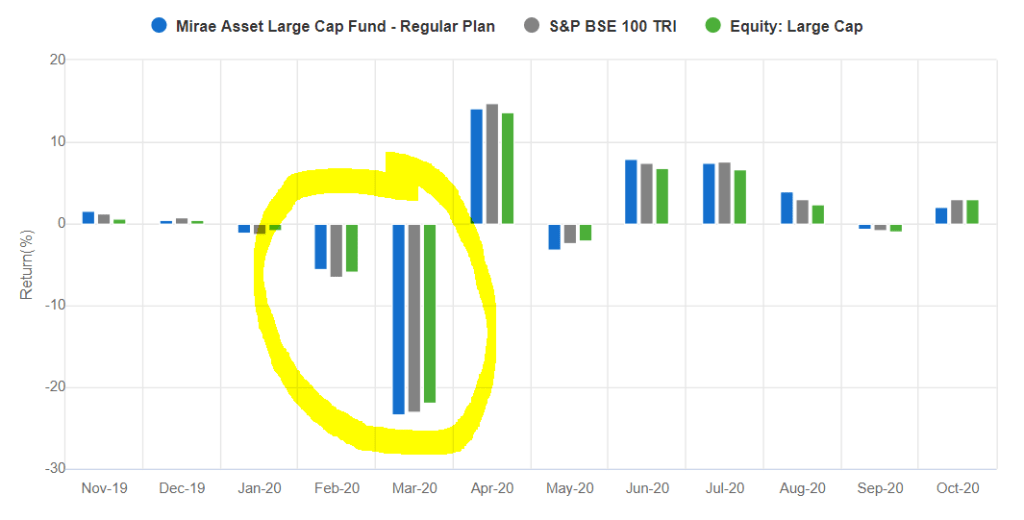

SIP vs. Lumpsum: Funds NAV performance mimics the BSE index. As a value investor, I like to buy things cheap and prefer lumpsum investment. I aim to invest more when the NAV is down 5% or more. For example, NAV was down 20% in Mar 2020, I would have invested the amount that I have planned to invest for the whole year. If you don’t have time to keep track of the market, then you may choose SIP.

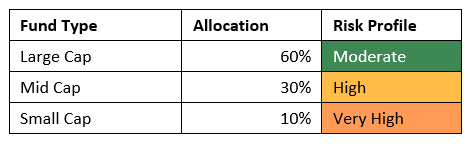

Asset Allocation:

Return Expectations:

Buffett Formula:

Fund total returns = GDP growth (6%) + inflation (4%) + dividend yield (2%)

I would have a realistic expectation of an additional 5-6% above the fixed deposit (FD) rates. For example, currently, FD rates are 5-6%, I would expect 11-12% per annum from mutual funds.

Rating:

I seek to invest in funds that have five-star or four-star ratings. I keep track of the fund manager, performance and ratings every year. If the ratings go to three-star or below, I switch to other funds with five-star or four-star ratings.

Expense Ratio:

I seek to invest in funds that have a relatively low expense ratio within the fund category. You can earn 1.5% more via direct investment plans (no commission paid to brokers).

Risk Grade:

I seek to invest in funds that take fewer risks to generate good returns. I avoid funds that invest in low-quality business.

Turnover:

I seek to invest in funds with low turnover. The percentage of fund’s portfolio that is churned in the last one year. Lower the better.

Fund Manager:

I only invest in funds managed by good fund managers/investors. I look at the track record of the fund managers for at least 10 years to distinguish skill from luck. Rajeev Thakkar, R Srinivasan are good fund managers.

Value Investor Rajeev Thakkar:

https://www.flame.edu.in/academics/executive-education/flame-investment-lab/resources/rajeev-thakkar

Disclaimer:

For educational purposes only.

Leave a comment