-

Aptus Value Housing Finance — Niche Market Leader

Aptus Value Housing Finance was founded in 2009, primarily focused on providing home loans to self-employed individuals and low-to-middle-income segments in rural and semi-urban areas. The company primarily targets the underserved and unserved segments of the housing finance market, particularly self-employed customers who often face difficulties in accessing credit from traditional financial institutions. Aptus offers Continue reading

-

Mr. Anandan scores big in second innings

Mr. Anandan Munuswamy began his career as a management trainee at the Murugappa Group, where he spent 30 years advancing to executive director and managing director roles, overseeing the growth of the company’s financial and investment services. Upon retiring at 60, Anandan pursued entrepreneurial endeavours. Drawing from his extensive experience in financial markets, he recognized Continue reading

-

How Mahindra Finance Compares to Its Peers: Why the Discount?

Mahindra Finance is a leading NBFC with a focus on rural and semi-urban India. With assets exceeding Rs. 1 lakh crores and a wide network of 1402 branches serving over 9 million customers. The Company’s primary focus is on financing the purchase of new and pre-owned automotive vehicles, including tractors and commercial vehicles. Originally focused Continue reading

-

Nalanda Capital’s Mantra

Image Credit | Assoc. Prof. Promila Agarwal Don’t just be lazy.Be very lazy.Don’t sell. Track record:16-Year CAGR: Nalanda: 19% vs Nifty: 9.5% About Pulak Prasad:Founder of Nalanda Capital Portfolio Construct:Portfolio of 30 stocksHigh concentration75% in 5 companies> 9 companies returned 25xAverage holding period of 11-14 years Investment Mantra:Not long term, permanentNot equity investors, business ownersHigh Continue reading

-

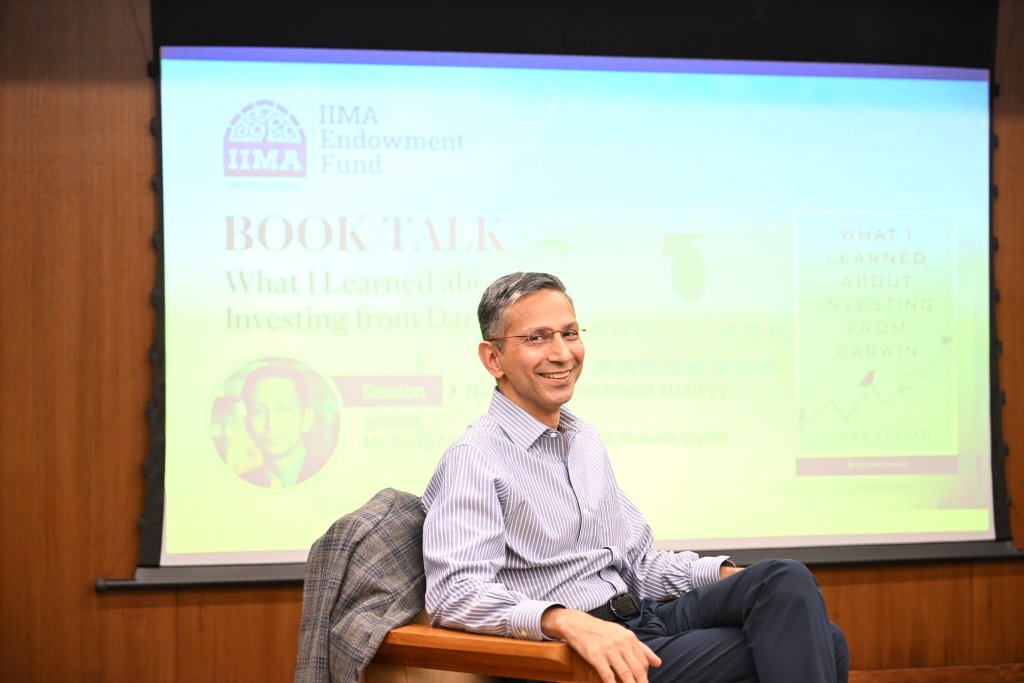

This book changed how I practice investing

I’m an individual investor since 2007 and have read many books about investing. I have changed how I practice investing thanks to Pulak Prasad’s book, What I Learned About Investing from Darwin. Pulak is the founder of Nalanda Capital. Here’s the summary of my learnings from Pulak’s book. Nalanda’s approach to investing comprises three steps: Continue reading

-

What I Learned About Investing from Darwin by Pulak Prasad

SECTION I: AVOID BIG RISKS 📕 Eliminate serious risks Would you bet your life on your next investment? Learning the skill of not investing is harder and more important than learning how to invest. An essential prerequisite for making money is the ability not to lose money. 📕 Almost everyone makes mistakes There are two Continue reading

-

Kotak Mahindra Bank – Annual Report Analysis

Is the business simple and understandable? Kotak Mahindra Bank (KMB) is one of the leading banks in India. The bank’s business operations can be broadly categorised into various segments such as retail banking, corporate banking, investment banking, wealth management, and insurance. The bank also operates subsidiaries in areas such as asset management, stockbroking, and alternate Continue reading

-

Jyothy Labs – Annual Report Analysis

Is the business simple and understandable? Jyothy Labs Limited (JLL) operates in two primary business segments: Fabric Care: JLL’s fabric care segment includes products such as laundry detergents, fabric whiteners, and fabric softeners. The company’s flagship brand in this segment is “Ujala,” which is a fabric whitener and brightener. Other brands in this segment include Continue reading

-

BKT Tires – Annual Report Analysis

Key Insights from Annual Report. Summary: BKT is a leading player in the Global Off-Highway Tire (OHT) market. BKT has a deep understanding of the OHT market, and has more than 3,200 SKUs. BKT will achieve a total capacity of 3,60,000 MTPA by FY23. BKT operates in large varieties – low volume segment which is Continue reading

-

10 Attributes of Great Investors

Credit Suisse’s full report: Ten Attributes of Great Investors by M.J. Mauboussin, D. Callahan, D. Majd Continue reading

-

Technology Platforms

Technology is my language. I trained Consultants who become Partners, Managers who become CIOs, and Partners who become Senior partners. Now it’s time to tell my daughter what I do. My daughter: Appa, what do you do?Me: I am an Enterprise Architect.My daughter: I understand architects who design houses. What do you actually do?Me: I Continue reading

-

Biocon – Risky bet on global biosimilars business

Published: Mar 21, 2022 Summary: Biocon is a global biopharmaceutical company finding affordable ways to treat diabetes, cancer, and autoimmune diseases. Its businesses include Generics, Biosimilars, Research Services, and Novel Biologics. It has 13,500+ employees. Biocon Biologics, a subsidiary of Biocon, develops high-quality affordable biosimilars. Biocon Biologics buys Viatris biosimilars assets for $3.33 billion. Viatris Continue reading

My Value Picks

Building habits to create a new identity as a passive investor. Get 1% better everyday. Mostly inactive on markets.