Mahindra Finance is a leading NBFC with a focus on rural and semi-urban India. With assets exceeding Rs. 1 lakh crores and a wide network of 1402 branches serving over 9 million customers. The Company’s primary focus is on financing the purchase of new and pre-owned automotive vehicles, including tractors and commercial vehicles.

Originally focused on financing Mahindra vehicles, it has now expanded its offerings to include financing for other Mahindra products, leading OEMs, as well as diversified products such as SME Finance and Mutual

Funds through its subsidiaries.

Risks:

Mahindra Finance has a strong focus on rural and semi-urban markets, which often come with unique challenges in assessing credit risks. The effectiveness of its underwriting process is subject to fluctuations driven by market dynamics, regulatory changes, and internal factors within the organisation.

A significant portion of economic activity in these areas operates in the informal sector, making it difficult to assess creditworthiness and enforce repayment. This poses risks for financial institutions in terms of loan recovery and asset quality.

Rural livelihoods often depend on agriculture, which is subject to seasonal fluctuations and weather risks. Income levels can vary significantly throughout the year, impacting borrowers’ ability to repay loans

consistently.

In addition, Mahindra Finance faces intensified competition from banks, increasing funding costs, and talent retention issues, which collectively influence its operational efficiency and growth prospects.

Sep 22, 2022: RBI Action

RBI barred Mahindra Finance from using third-party services for loan recovery until further orders. However, the company can carry out recovery activities using its own employees. RBI action came days after reports of a woman allegedly being fatally injured while trying to stop a loan recovery agent in Jharkhand.

Apr 24, 2024: Loan Fraud

The fraud was exposed during a management review of the North-East branch. Around 2,887 loan accounts were found to be fraudulent, with an outstanding balance of Rs. 136 crores. In response, Mahindra Finance has set up a fraud control unit to strengthen underwriting and onboarding processes. Additionally, half of the branches have been centralised, with plans to centralise the remaining 50% by FY25E.

Competitive advantage:

The annual report highlights several factors that may contribute to its competitive advantage in the financial services sector. These factors include:

Long Track Record of Operations: Mahindra Finance has operations in the rural and semi-urban markets for more than 25 years and dealing with a variety of profiles. It is a market leader in tractor financing and has a strong position in UV (utility vehicles) financing.

Vast Distribution Network: Mahindra Finance has built a vast distribution network especially in rural areas and small towns. This broad presence gives them a competitive edge in terms of accessibility and customer reach.

Diversified Product Portfolio: It provides a range of financial services, including Vehicle Loans, SME Finance, Personal Loans, Insurance Broking, Housing Finance, Fixed Deposits and Mutual Fund schemes.

Strong Management: As a part of the Mahindra Group, Mahindra Finance benefits from the strong brand reputation and trust associated with the group. This can be a significant competitive advantage in gaining customer trust and loyalty.

High Credit Rating: Mahindra enjoys highest rating (AAA/Stable) for its long-term and short-term borrowing from all the credit rating agencies it is associated with. Its credit ratings and strong brand equity enables it to borrow funds at competitive rates.

Although challenges and uncertainties are common in the financial services sector, Mahindra Finance’s strong fundamentals, strategic initiatives, and commitment to sustainable growth suggest favourable long-term prospects.

Management:

Mahindra Finance is part of the respected and trusted Mahindra Group. Anand Mahindra is a highly regarded and influential businessman in India. His leadership and substantial contributions to the corporate sector have earned him widespread respect. Mahindra’s achievements are admired by peers, employees, and society at large. Mahindra Finance has been recognised for its corporate governance standards and has received various awards in this regard.

Raul Rebello is the MD and CEO at Mahindra Finance, succeeding Ramesh Iyer, who retired in April 2024. Raul brings over 19 years of experience from Axis Bank, where he served as the head of Rural Lending and Financial Inclusion.

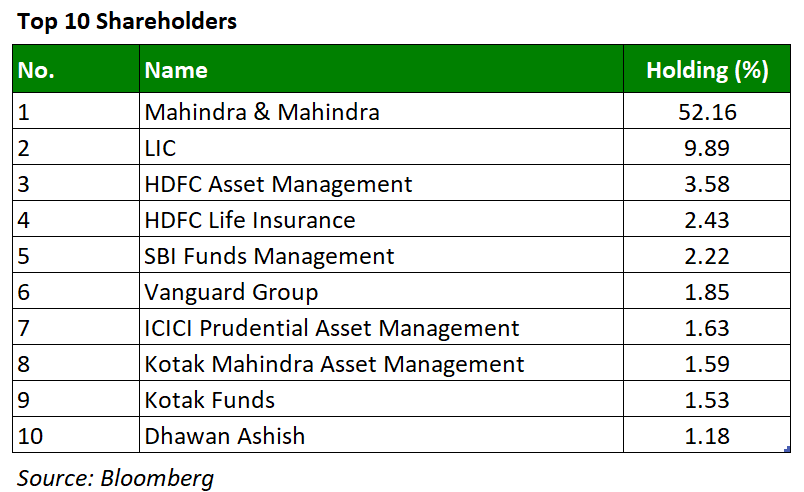

Investors:

Promoters hold 52% of the company

Foreign Investors hold 11.9% of the company

Mutual Funds hold 28.6% of the company

Valuation:

Historically, Mahindra Finance has traded in the P/B range of 1.2 to 2.4. Currently, it is trading at 1.5 times its book value. At the current P/E of 16, the earnings yield stands at 6.25%.

However, it is important to note that a company’s valuation cannot be determined solely by one metric. Factors like the company’s financial performance, growth potential, and market conditions should also be considered.

Investors should conduct a thorough analysis of its financial statements, industry trends, and other relevant factors before making any investment decisions. Additionally, past performance does not guarantee future results, and the company’s valuation may fluctuate in response to changing market conditions and other factors.

Dividend:

At Rs. 250 per share, the dividend yield stands at 2.4%.

Source: Annual Reports, Analyst Reports, AI

Disclosure:

For educational purposes only. Not a recommendation to buy or sell.

Leave a comment