Aptus Value Housing Finance was founded in 2009, primarily focused on providing home loans to self-employed individuals and low-to-middle-income segments in rural and semi-urban areas.

The company primarily targets the underserved and unserved segments of the housing finance market, particularly self-employed customers who often face difficulties in accessing credit from traditional financial institutions.

Aptus offers home loans for the purchase or construction of residential properties, home improvement loans, and loans against property.

Aptus has 262 branches and 2000 employees serving over one lakh customers. It is one of the largest housing finance companies in South India.

Risks:

Since Aptus primarily serves low-to-middle-income segments and self-employed individuals, the risk of borrower default is higher compared to traditional housing finance companies. These customers often have irregular income streams and less stable financial backgrounds.

Economic slowdowns or downturns can significantly impact the ability of borrowers to repay their loans, leading to higher non-performing assets (NPAs).

Increases in interest rates can lead to higher borrowing costs for the company, which may not be fully passed on to customers. This can compress net interest margins (NIM) and affect profitability.

The loan portfolio of Aptus is less seasoned as majority of the portfolio was originated during the last five years. The loan portfolio continues to be concentrated in Tamil Nadu and Andhra Pradesh.

Rapid expansion in new geographies may pose challenges related to operational efficiency, quality control, and consistency in service delivery. Maintaining good asset quality while scaling operations is a key sensitivity.

Increased competition from other housing finance companies, banks, and fintech lenders can lead to pricing pressures, reduced market share, and increased customer acquisition costs.

Any lapses in customer service, or unethical practices can harm the company’s reputation, leading to loss of customer trust and potential regulatory scrutiny.

Risk Management:

Aptus handles all aspects of its lending operations in-house, including sourcing, underwriting, collateral valuation, legal assessment, and collections. This approach allows the company to maintain direct contact with customers, reduce turnaround times, and minimize the risk of fraud.

Aptus has a track record of maintaining low non-performing assets (NPAs), showcasing prudent lending practices and strong credit assessment.

Aptus employs stringent credit assessment processes, which help in maintaining low NPAs and managing credit risk effectively.

Competitive advantage:

The annual report highlights several factors that may contribute to its competitive advantage in the financial services sector. These factors include:

- Niche Market Leader: Aptus has established a strong position in the niche market of housing finance to underserved and unserved segments, particularly focusing on customers who typically face difficulties in accessing credit from traditional financial institutions. Its deep understanding of this market gives it a competitive edge.

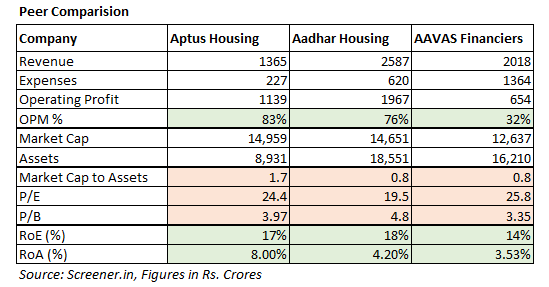

- Efficient Operations: The company’s efficient operational model, including low operating costs and robust risk management practices, contributes to its competitive advantage and financial performance. It has consistent profitability with RoA at 8% and RoE at 17.25% despite challenges at macro level. It is a leader in attractive south market.

- Reputation and Trust: Aptus has built a reputation for reliability and trustworthiness among its customers, which is crucial in the financial services industry.

- Strong Founder Promoter: Anandan Munuswamy has extensive experience in the financial services sector. Before founding Aptus, he held various senior positions in Cholamandalam Finance.

- Regulatory Support: Favourable government policies aimed at promoting affordable housing and financial inclusion.

Aptus Value Housing Finance’s competitive advantages include its focus on underserved market segments, conservative credit policies, operational efficiency, strong financial performance, focused lending, reputable backing, and low funding costs.

Management:

Anandan Munuswamy began his career as a management trainee at the Murugappa Group, where he spent 30 years advancing to executive director and managing director roles, overseeing the growth of the company’s financial and investment services.

Upon retiring at 60, Anandan pursued entrepreneurial endeavours. Drawing from his extensive experience in financial markets, he recognized a gap in the banking sector, which primarily catered to salaried workers. He identified a promising, underserved market of small traders, vendors, cleaners, and self-employed individuals who had regular incomes but lacked the necessary bank statements and returns to secure loans.

In 2009, Anandan founded Aptus Value Housing Finance, targeting the low-income and affordable housing markets. For the first three years, he personally approved every loan, instilling a robust in-house credit culture. Since its inception, Aptus has enabled thousands of individuals in underserved rural and semi-urban areas to build their dream homes.

Investors:

- Anandan and his family hold 24.6% of the company

- Westbridge holds 34.5% of the company

- Foreign Investors hold 19.6% of the company

- Mutual Funds hold 5.1% of the company

- M.A. Alagappan holds 1.2% of the company

The involvement of seasoned business leaders like M.A. Alagappan adds further credibility and strategic insight. His investment indicates confidence in the company’s leadership and business model.

In May 2024, SBI Mutual Fund added 1.82 crore shares of Aptus Value Housing Finance at ₹294 per share.

Why the Premium?

Aptus Value Housing Finance has experienced significant growth since its inception in 2009. Starting with a single branch, Aptus has expanded to 262 branches across various states in the last 15 years.

Aptus has consistently improved its financial performance, with significant increases in revenue and profitability over the years. The NIM improvement reflecting efficient management of interest income and expenses. There is no price history for Aptus Value Housing Finance. Aptus got listed in August 2021. The IPO issue price was ₹353 per share and priced at P/B of 6.85. Currently, it is trading at 3.97 times its book value and 24.4 times price to earnings.

However, it is important to note that a company’s valuation cannot be determined solely by one metric. Factors like the company’s financial performance, growth potential, and market conditions should also be considered.

Investors should conduct a thorough analysis of its financial statements, industry trends, and other relevant factors before making any investment decisions. Additionally, past performance does not guarantee future results, and the company’s valuation may fluctuate in response to changing market conditions and other factors.

Dividend:

At Rs. 300 per share, the dividend yield stands at 1.5%.

Source: Annual Reports, Analyst Reports, AI

Disclosure:

For educational purposes only. Not a recommendation to buy or sell.

References:

https://westbridgecap.com/people/founder/munuswamy-anandan

Videos:

Mr. Anandan wins the “Self-Made Entrepreneur” Award by Nanayam Vikatan

Leave a comment